George Osborne's determination to retain controversial tax incentives offered to businesses with lucrative patents is expected to leave Britain out on a limb when G20 finance ministers meet in Australia at the weekend.

The chancellor will not be there in person – reportedly remaining in the UK to deal with the aftermath of the Scottish referendum on independence – but his commitment to international tax reform is expected to be high on the list of topics under discussion.

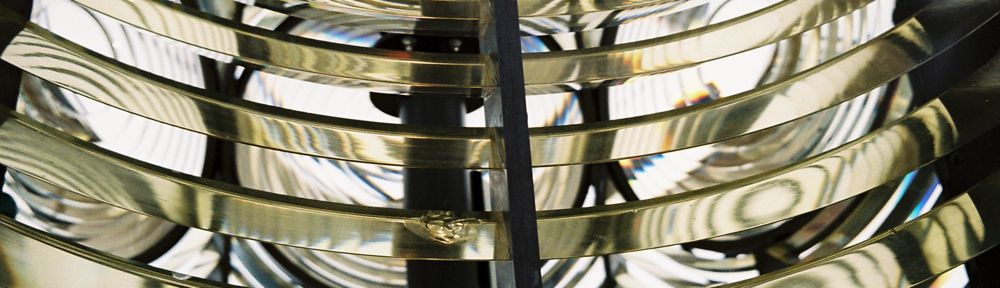

The UK's patent box tax break, which came into effect in April last year, is designed to attract and nurture research and development companies in the UK. UK-based companies are entitled to a lower tax rate on profits from work related to patents that qualify for the scheme.

The move has become the most conspicuous sticking point for negotiators involved in the programme of international tax reform being drafted by the Organisation for Economic Cooperation and Development, with the majority of those involved judging the scheme to be so poorly targeted, and damaging to foreign treasury coffers, as to be classed as "harmful tax competition".

Nevertheless, Osborne is determined to hold on to the new incentives, leaving the UK isolated – together with the Netherlands and Luxembourg – and resisting pressure from other nations.

The German finance minister, Wolfgang Schäuble, has already publicly criticised the UK scheme. "That's no European spirit," he said in July last year. "You could get the idea they are doing it just to attract companies."

The attack appeared to mark a sharp cooling in previously warm relations between Osborne and Schäuble. It came just eight months after the two had issued a surprise joint statement calling for the OECD to accelerate its work on tax reform.

In the statement, both finance ministers condemned out of date rules that allowed "some multinational businesses to shift the taxation of their profits away from the jurisdictions where they are being generated". Now Osborne is accused of inviting such behaviour.

Concerns about the controversial incentives have already been taken to the European Union's code of conduct committee, and they have been criticised in Britain by the Institute for Fiscal Studies.

Osborne has insisted patents are a legitimate focus for tax breaks because of "a particularly strong link to ongoing high-tech research and development". But the IFS noted that "the policy does not require that the innovative activity underlying a patent takes place in the UK".

The patent box scheme – first proposed under the previous Labour government –has also been criticised for handing big savings to large groups which account for the majority of patents, such as the pharmaceutical company GlaxoSmithKline.