America's willingness to back the pioneering entrepreneurs that have transformed its industries and fuelled its economy should not be underestimated. From Henry Ford to Thomas Edison and, more recently, Steve Jobs, those who have harnessed technology to create vast wealth cast a long shadow over the new world's corporate history.

Loyalty to the visionary may go some way to explaining why, the day after Amazon warned that its operating loss in the coming September quarter could be as high as $810m, support for its founder shows no sign of wavering.

Jeff Bezos has a reputation for sacrificing profits in favour of long-term growth, but the warning still came as a shock. Wall Street had been expecting just $8m. The shares dived 15%, wiping £15bn from Amazon's stock market value.

The heads of British chief executives have rolled for less. Tesco's business may be shrinking, but it was still making a £3bn profit when Philip Clarke was ousted last week. Two years ago, AstraZeneca's David Brennan had to fall on his sword earlier than planned because of a lacklustre drugs pipeline.

But reaction to Amazon's profit warning among the analysts who set the tone on Wall Street was a series of reiterated buy recommendations. "One of the best management teams on the internet," cheered broker RBC Capital Markets. "We still have conviction," declared the equity strategists at Morningstar.

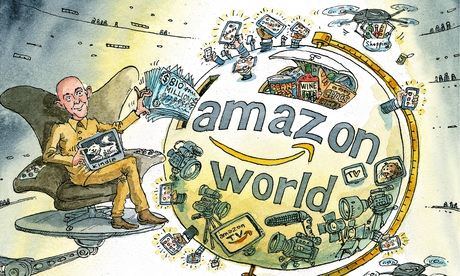

The reasons given for the upcoming losses are a very diverse range of aggressive, well-funded investments. Amazon is investing in faster dispatch for all goods, with more Sunday and same-day deliveries. More ambitiously, it wants to become an online grocer, bringing fresh food to the doorstep just like Ocado or Sainsbury's. AmazonFresh drivers are already dropping off weekly shops in Los Angeles and San Francisco.

Even more ambitiously, Amazon Studios is having a stab at becoming the next HBO or Netflix, committing $100m in the current quarter alone to commissioning its own shows. This spring, it gave the green light to six full series. There is a new instalment of the Birmingham crime drama Peaky Blinders, co-produced with the BBC, and supernatural thriller The After, from X-Files creator Chris Carter. There are no half-measures here: a third wave of pilots later this year will include no fewer than 10 new shows.

Amazon may make more money from general merchandise, but its window display has always been entertainment – books, music, films, TV series; a sector that will sooner or later be sucked into a black hole. Digital downloads are doing away with the need for warehouses full of CDs and box sets.

And Amazon is far from dominant in the download arena. The device makers and software writers – Google with its Playstore and Apple with iTunes – are already building billion-dollar music and video retail businesses. And so Amazon is building its own devices. First a tablet, then a set-top box, and now a mobile phone.

Creating hit television series, running an online supermarket, making smartphones: these are difficult things to do well, even for companies that specialise in only one of them at a time. None the less, Amazon's can-do approach has proved doubters wrong in the past – most notably with its Kindle tablet.

But Bezos wants customers to live in a company town, in the same way that some of its authors write books that are published by Amazon, reviewed by Amazon customers, sold in its online store, and read on its Kindles. The model has a niche in the book trade, but how many people will watch The After on a Fire TV box, while munching popcorn delivered by AmazonFresh?

Amazon should focus on retail and forge alliances – with device makers, TV companies and studios. Unfortunately, while Bezos has achieved much, his turbulent relationship with the publishing industry suggests alliances are not his strong suit.

Wage inflation? We'll believe it when we see it

The timing of the first interest rate rise in more than five years will depend on how many workers get a decent wage rise. Bank of England rate setters let it be known at their last meeting that inflation-busting pay is a key indicator of an economy's health, and a trigger for higher rates.

Optimists believe that, after six years of falling real incomes, workers are due an above-inflation rise. So far it hasn't come, but they argue that staff shortages will soon translate into higher pay.

As the Bank's regional agent network recently reported, the UK is facing the worst recruitment difficulties since the beginning of 2008. Recruitment agencies are also recording record rises in starting salaries for new employees. So wages are on the up. Are interest rates too? The flipside of this argument can be found in the minutes from July's MPC meeting.

Officials said a halving in average weekly earnings growth to 0.7% in the three months to April, from 1.4% in the three months to January, could reflect a trend for new jobs to be "concentrated in lower-paid sectors". It added: "Perhaps relatedly, recent employment growth had been more heavily skewed towards lower-skilled occupations."

Rate setters also worry about self-employment, up by 700,000 since 2008 and accounting for more than two-fifths of job creation in this parliament. Many new members of this 4.5 million-strong sub-group are redundant public sector workers picking up contract work. Then there are the 100,000 or so construction workers who have probably rejoined the ranks of the self- employed. It is a mixed bag of people, some of whom could see their incomes rocket as the economy recovers, and others who won't.

George Osborne said last week he expects a bumper tax take in January when the self-employed pay their contributions. He may be right. But it may not be all they are paying. Higher mortgage payments could be another hit on their bank account soon.

RBS shares are up – but the watchdog still lurks

Royal Bank of Scotland has set an upbeat tone for the start of the half-yearly reporting season for high street banks. Belting out its profits a week early, the bailed-out bank has raised the bar for rivals.

Barclays and Lloyds Banking Group were dragged up the FTSE 100 leader board on the back of the 10% jump in the RBS share price on Friday; handily, Barclays and Lloyds are due to report his week. Better news about the economy was demonstrated in the dramatic fall in RBS's provisions for bad debts, and official data showing the economy has recovered the losses it incurred during the banking crisis. Such things bolster sentiment.

But as RBS spelt out, no matter how much good news there is around, there is always the lingering problem of conduct and litigation risks. This week may well provide more evidence of these party poopers.